Disney’s streaming growth continues to shine despite challenges in its traditional TV segment.

The Walt Disney Company has once again demonstrated the growing strength of its streaming platforms, with Disney+ subscribers rising by 3.8 million in the fourth fiscal quarter of 2025. This impressive growth brings Disney+’s total subscriber base to 132 million, while the combined Disney+ and Hulu subscribers reached 196 million — surpassing Wall Street expectations.

Disney Reports Strong Streaming Performance Amid Flat Revenue

Disney released its Q4 2025 earnings report on Thursday, revealing total revenues of $22.5 billion, remaining steady year-over-year. The company’s operating income stood at $3.5 billion, marking a 5% decline compared to last year.

Despite the challenges posed by the ongoing decline in traditional TV viewership, Disney’s streaming business continues to outperform projections. The company’s direct-to-consumer revenue rose by 8% to $6.2 billion, while operating income surged 39% to $352 million, reflecting strong engagement and growing profitability in the streaming sector.

Subscriber Growth Defies Challenges

This quarter’s growth is particularly notable given two potential headwinds: the brief suspension of Jimmy Kimmel, which sparked controversy, and the announcement of upcoming Disney+ price hikes. However, Disney’s subscriber numbers remained resilient. Analysts suggest that the full impact of subscription cancellations may not be reflected until the next quarter, as subscription renewals typically lag behind announcements.

Interestingly, Disney also revealed that it plans to stop reporting individual streaming subscriber counts starting next quarter — a move that could shift investor focus toward profitability rather than raw growth metrics.

Disney’s Other Divisions: Experiences and Sports Continue to Perform

Beyond streaming, Disney’s Experiences division — which includes theme parks and resorts — reported a solid 6% revenue increase to $8.8 billion, with operating income rising 13% to $1.9 billion. The Sports segment, anchored by ESPN, showed a modest 2% rise in revenue to $4 billion, though its operating income dipped 2% to $911 million due to the ongoing impact of cord-cutting.

However, the Linear TV segment continued to struggle, with revenues dropping 16% to $2.1 billion and operating income falling 21% to $391 million. Overall, the entertainment division, which combines linear, streaming, and studio operations, generated $10.2 billion in revenue, down 6% year-over-year, with operating income down 35% to $691 million.

Disney’s Outlook for 2026 and 2027

Looking ahead, Disney shared optimistic projections for fiscal 2026 and 2027. The company expects double-digit operating income growth in its entertainment business next year, with an estimated 10% operating margin in its direct-to-consumer (streaming) segment. The Sports division is forecasted to achieve low single-digit growth, while Experiences should see high single-digit gains.

For fiscal 2027, Disney anticipates double-digit EPS (earnings per share) growth, signaling confidence in its long-term strategy.

Disney Rewards Shareholders with Dividend and Buyback Boost

In a move welcomed by investors, Disney announced a 50% increase in its annual dividend, raising it to $1.50 per share from $1 previously. The company also doubled its share repurchase plan to $7 billion, underscoring its commitment to shareholder returns.

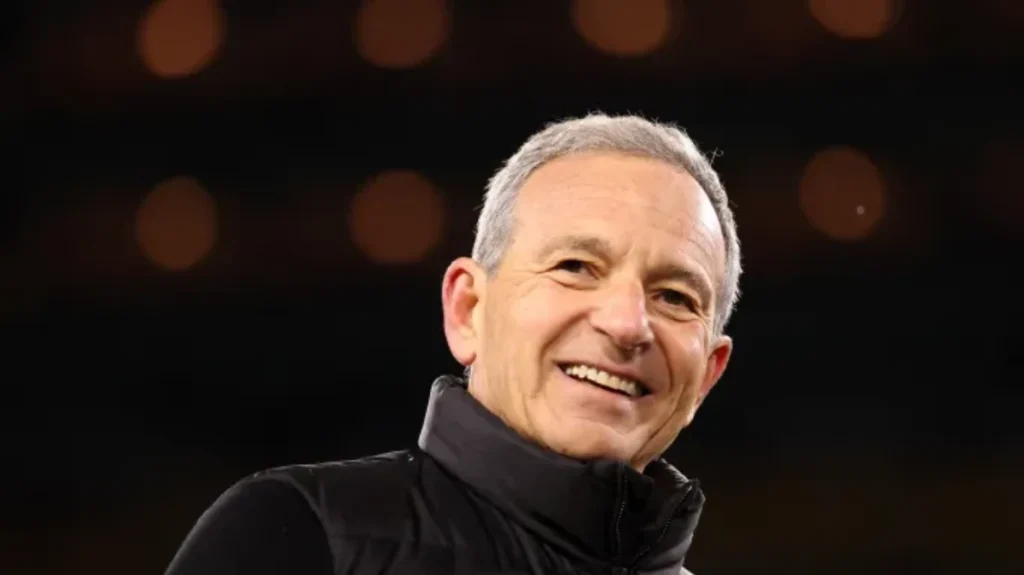

CEO Bob Iger: “A Year of Great Progress”

Disney CEO Bob Iger praised the company’s performance, stating:

“This was another year of great progress as we strengthened the company by leveraging the value of our creative and brand assets and continued to make meaningful progress in our direct-to-consumer businesses. Our strategy, coupled with our portfolio of complementary businesses and a strong balance sheet, enables us to continue investing in high-quality offerings for our consumers and increasing our returns to shareholders.”

Final Thoughts

Disney’s Q4 2025 report highlights a clear trend: streaming is driving the company’s growth, while traditional TV continues to decline. With Disney+ subscriber growth exceeding expectations, rising streaming profits, and a strong financial outlook for 2026 and 2027, the company appears well-positioned to lead the entertainment landscape in the digital era.

Also Read: HMRC Reviews Suspension of 23,500 Child Benefit Payments After Complaints